In general, one of the sectors that contributes most to India’s development is the transportation and logistics sector. Yes, any issue with the transportation system has the potential to halt a nation’s progress.

Indeed, the development of India’s economy has been greatly influenced by the transportation sector. The entire business channel may be affected if we were to shut down the transportation system for a single day.

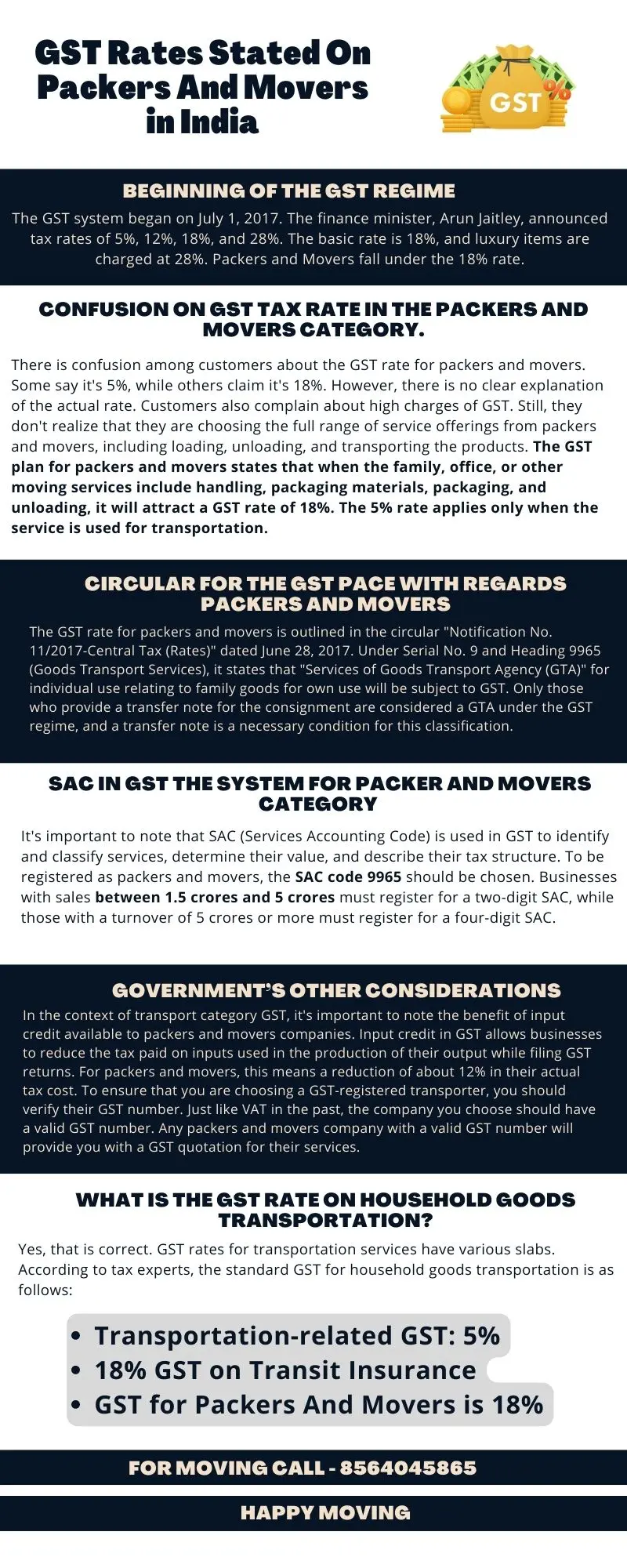

As a result, you ought to let your misconception regarding GST on packers and movers go. It would help if you comprehended what it is.

When was the GST introduced? The Goods and Services Tax (GST) is a comprehensive indirect tax system in India that became well-known in 2017.

In actuality, it absorbed several previous indirect taxes, such as the service tax, the state value-added tax, and the central value-added tax (VAT). You should be aware that all products and services provided in India, including packers and movers’ services, are subject to the Goods and Services Tax (GST).

Recognizing GST in India for 2024 Movers and Packers:

You should be aware that the GST tax rate for packers and movers varies depending on the type of services rendered. Additionally, the GST charge is 5% if the packers and movers just offer transportation services. On the other hand, the

GST rate is 18% if the packers and movers offer a full relocation service, which includes packing, unpacking, loading, unloading, and insurance. However, bear in mind that if the packers and movers offer transit insurance for the items being moved, the GST charge is also 18%.

| Only Transportation | 5% |

| Full-service moving (packing, dismantling of appliances, loading, unloading, transportation, and insurance included) | 18% |

| Include Transit Insurance (Moving insurance ) | 18% |

| Transit insurance (Standalone) | 18% |

It is crucial to remember that the GST rates are subject to change, therefore it is advisable to confirm the most recent rules before deciding.

Would you like to relocate your home? The GST rate applicable to it:

The value of the things you wish to move will determine the GST on packing costs for residential relocation. The GST rate is 5% when the value of your items is less than ₹5,000,000. The GST rate is 18% for movements involving items worth more than ₹5,000,000.

Understanding the GST on Commercial Relocation is important:

The type of business determines the GST on commercial migration. For example, the GST rate for packers and movers while moving a manufacturing unit is 18%, but the GST rate when moving a retail business is 5%. To properly plan your commercial move budget, you must comprehend these rates.

Real estate professionals’ GST rate:

During a transfer, real estate agents can be quite helpful in guiding customers through the intricacies of GST. They can help clients locate packers and movers who have got approval with GST and explain the various GST rates that apply to residential and commercial relocation. This can facilitate a more seamless transition during real estate sales.

GST In adherence to movers and packers:

In India, movers and packers who offer taxable services must register for GST. Getting a GSTIN (Goods and Services Tax Identification Number) and adhering to GST laws are essential steps in this registration procedure.

In addition, packers and movers have to keep correct records for all taxable services rendered and present correct GST bills.

Are Packers and Movers Charges Under GST Correct?

According to GST, the appropriate packers and movers’ fees will be determined by the following:

- The type of services offered

- The distance that needs to be covered

- The volume and weight of the items being transported

- The merchandise being transported is worth

- The season

- The accessibility of local packers and movers

- Obtaining quotations from many packers and movers is crucial before finalizing your choice.

Additionally, confirm that the movers and packers you select have a GST registration.

Relocation Allowance as an Expense Offset:

A company or educational institution may provide a tax-free relocation allowance to assist people in defraying the costs associated with moving.

This exemption can be strategically used by both individuals and corporations to deduct the GST paid on moving-related expenses. They can lessen the financial effect of GST on their migration by doing this.

Under what conditions is the transportation of goods exempt from GST?

If you are moving items from one location to another without hiring a courier service or professional packers and movers, you may be free from paying shipping taxes.

Again, you are exempt from GST if you carry products via inland waterways. Remember that if you use reputable logistics firms or packers and movers to deliver your items, GST will be charged.

Note: The current GST rate for packers and movers varies according to the services you use from the provider; it can be anywhere from 5% and 18%. Goods transportation is free from goods transportation tax (GST) if the packers and movers bill less than Rs. 1500.

Advice for Optimising GST:

Take into account the following advice to minimize GST costs when moving:

Preparation:

To guarantee a seamless transition and to obtain precise prices from several packers and movers, start your move preparation well in advance.

Selecting Authorized Suppliers:

Choose movers and packers who have registered with the GST to guarantee transparency and compliance.

Keeping Track of GST Invoices:

Make sure that all GST bills have accurate documentation, which includes information about the services rendered and the relevant GST rates.

Making the Most of Relocation Allowance:

Maximize your relocation allowance to efficiently deduct GST-related costs.

How Is 1Support Able to Help?

For people, companies, and real estate experts, it is essential to comprehend and manage GST on packers and movers services in India.

The effect of GST on your moving costs can be reduced by using relocation allowances wisely and being knowledgeable of the applicable GST rates and compliance obligations.

To guarantee a smooth migration procedure, be knowledgeable about GST laws and, where necessary, seek professional help.

For professional advice and flawless moving services, give 1Support Packers and Movers a call. Our staff is ready to help you through each step of the procedure and ensure a stress-free, extremely effective move.

If you are paying additional GST, don’t forget to verify the moving company’s GST registration. Make sure that the packers and movers you choose are GST-registered and have a valid GSTIN number.

You may steer clear of any fraud by working with a licensed company. Via 1Support, you may engage packers and movers who have the approval of GST registration.