Two categories of human needs—essential and non-essential—can be made. Among the necessities are clothing, shelter, and food. In India, finding food and clothing is not too difficult. The rising cost of real estate nationwide has made it slightly more challenging to obtain suitable housing. Nevertheless, Every year, millions of individuals leave small towns and villages for big cities in quest of better prospects. The majority of people who relocate opt for rental accommodation as their first choice.

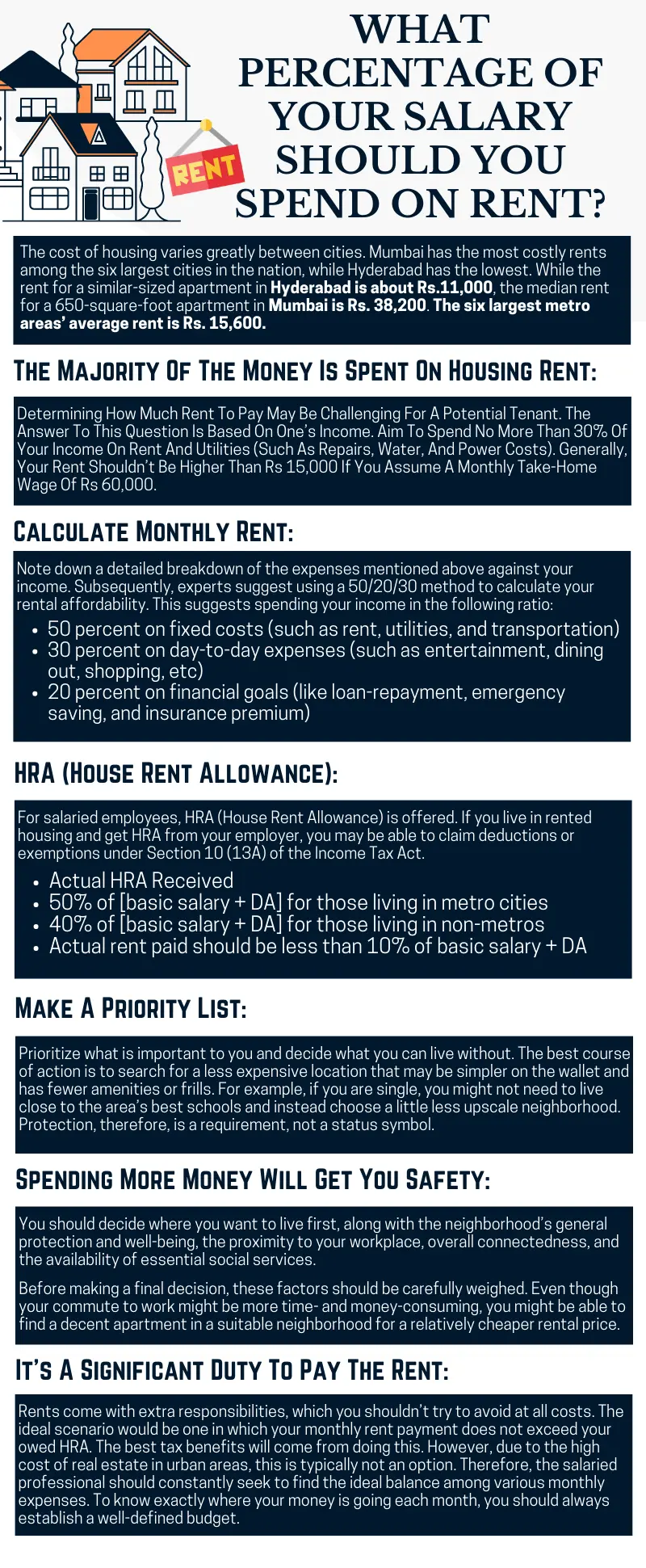

The cost of housing varies greatly between cities. Mumbai has the most costly rents among the six largest cities in the nation, while Hyderabad has the lowest. While the rent for a similar-sized apartment in Hyderabad is about Rs.11,000, the median rent for a 650-square-foot apartment in Mumbai is Rs. 38,200. The six largest metro areas’ average rent is Rs. 15,600.

The Majority Of The Money Is Spent On Housing Rent:

In some places, expensive rental housing has a disproportionately large impact on household costs. In a major metropolis, the typical household spends for housing with about half of its monthly income on. The potential for savings is much diminished when gasoline and food costs are taken into account.

For many families, the majority of their monthly incomes are spent on housing rent. This raises the issue of how much you should put on housing optimally. According to experts, the combined rent and utility costs shouldn’t be more than 30% of the monthly net take-home pay. Most consumers don’t include costs for utilities like water and power when estimating their rental expenses. Preferably, you shouldn’t be paying more than Rs. 21,000 in house rent if your net monthly income is Rs. 70,000. There are numerous possibilities in the rental housing market, each with a different price.

As a result, determining how much rent to pay may be challenging for a potential tenant. The answer to this question is based on one’s income. Aim to spend no more than 30% of your income on rent and utilities (such as repairs, water, and power costs). Generally, your rent shouldn’t be higher than Rs 15,000 if you assume a monthly take-home wage of Rs 60,000.

There is a limit to how much the electricity expenses may be cut, but the rent can be controlled. Rental prices vary between localities within a city, much as the wide variation in rentals across Indian cities. In the suburbs of a major city, one can find a suitable place to live. However, it is important to consider the costs associated with transportation as well as the time wasted traveling. The 30% cap can be reduced if you can significantly reduce your commute costs by paying a little more rent.

Indians spend a significant portion of their income on housing, food, and transit, according to numerous surveys. Even while high rental costs raise the monthly cost of the dwelling, the situation can be improved with wise money management. Moving to a new city in search of employment or for other reasons rarely happens instantly. Prioritizing your finances is crucial when moving. You can control all of the expenses and put money away for the future if you arrange your finances early and create a budget for both essential and non-essential demands.

In Cities, Rent Is Expensive:

Decide where you want to reside first, along with the area’s safety, accessibility, and travel time to work. For instance, you might find a nice home in an area with affordable housing. However, it can lengthen and increase the cost of your commute. Therefore, a residence that is more expensive and closer to your place of employment can be a better compromise.

Tenants search for certain facilities in a rental home. According to experts, even in India, while home rental prices have remained low at around 2%–3%, people sometimes spend up to 40%–50% of their monthly income on housing in major areas like Mumbai. The cost of housing in urban India is still expensive despite decreased rental income.

HRA:

For salaried employees, HRA (House Rent Allowance) is offered. If you live in rented housing and get HRA from your employer, you may be able to claim deductions or exemptions under Section 10 (13A) of the Income Tax Act. Naturally, this depends on the HRA amount you receive, the rental payment amount surpassing 10% of your salary, and if you live in a metropolis where your salary will be 50% of your salary and a non-metropolis 40% of your money.

No matter how much you pay in rent, you must determine the biggest exemption that is allowable. If there is a significant disparity between the rent that you pay and your basic salary, you might try talking with your HR to restructure the package so that a greater basic salary amount is displayed.

If any of the parts is lower than the exact rent paid, the total exemption would be that amount. You could talk with your boss to have your remuneration package restructured to reflect a greater basic salary if there is a significant difference between the rent paid and the basic wage. Handling the rent payment if the remuneration is insufficient. To receive the greatest tax savings, the ideal situation is for your monthly rent not to increase the HRA limit. Due to the high cost of urban real estate, this is frequently not feasible. Therefore, it becomes necessary for the person to strike a fair balance between different monthly expenses.

Therefore, the first step is to create a budget so that you can track your spending and know where your money is going. When choosing a rental property, abide by the 30% rule. Reduce that percentage as much as you can so that your monthly expenses are reasonable. To save enough money to cover your rent, you might also want to give up other indulgences like routinely eating out.

Make A Priority List:

Prioritize what is important to you and decide what you can live without. The best course of action is to search for a less expensive location that may be simpler on the wallet and has fewer amenities or frills. For example, if you are single, you might not need to live close to the area’s best schools and instead choose a little less upscale neighborhood. Protection, therefore, is a requirement, not a status symbol.

When we relocate for an extended period for business or other professional endeavors, staying in a rental is typically the first thing we do. Have you ever thought about how much of your income should go toward paying for housing, though? Since it frequently crosses over particular priorities, objectives, and different financial conditions, this is a topic that has historically aroused intense discussion among financial management specialists.

Spending More Money Will Get You Safety:

You should decide where you want to live first, along with the neighborhood’s general protection and well-being, the proximity to your workplace, overall connectedness, and the availability of essential social services.

Before making a final decision, these factors should be carefully weighed. Even though your commute to work might be more time- and money-consuming, you might be able to find a decent apartment in a suitable neighborhood for a relatively cheaper rental price. Therefore, a smaller but marginally more expensive rental home closer to your workplace might potentially be a better option. It all relies on how you interpret the circumstances and what is most important to you.

Rental prices typically increase significantly in upscale neighborhoods with excellent connections and social amenities. You will therefore need to pay a larger rent sum and, in many cases, a sizable deposit if you want to live in a posh area.

It’s A Significant Duty To Pay The Rent:

Rents come with extra responsibilities, which you shouldn’t try to avoid at all costs. The ideal scenario would be one in which your monthly rent payment does not exceed your owed HRA. The best tax benefits will come from doing this. However, due to the high cost of real estate in urban areas, this is typically not an option. Therefore, the salaried professional should constantly seek to find the ideal balance among various monthly expenses. To know exactly where your money is going each month, you should always establish a well-defined budget.

Along with investing as much as you can, you should also set aside 30% of your income for rent. The ratio of investment should be as high as possible. The perfect rental property should be reasonably priced, situated in a nice neighborhood, and have at least the bare minimum of amenities and connectedness to the rest of the world’s social infrastructure and transit networks. Of course, in addition to commutes to your place of employment, security should always be considered. Sharing a flat with another person or moving into a more affordable PG will also reduce your rental costs.